Using utilize to fund your financial investment home can be an excellent way to maximize returns and attain your financial investment objectives. However if you're a novice financier, it can be hard to know where to begin. To distill it all down, we chatted with Erik Peterson, home financing expert at Better Home loan.

Like many significant purchases made with funding, loan providers are going to wish to take a more detailed look under your monetary hood beginning with your credit rating. Here's how your credit rating effects eligibility and rates of interest options: 620: This is technically the minimum credit report required to finance a financial investment residential or commercial property.

And even then, your rate and expenses will not be as beneficial. 640-719: A score in this range suggests you might have to pay a cost to get a standard interest rate, or pay a higher rate of interest on your loan. 720-740: A credit score in this range will land you rates inline with what you generally see promoted.

Do not forget to consider the money you will need need left over in the bank after the down payment and closing expenses. "Typically, conventional lenders need a minimum of 6 months of home mortgage payments as reserves after you close. In case something were to take place, this ensures you might cover 6 months," describes Peterson.

It's likewise essential to understand that gift funds can't be utilized for an investment home. Unlike the purchase of your main house, all the funds should be yours or the co-borrower's. While you can put as low as 3% down on your own home, really few home mortgage loan providers will deal with less than 20% down when it comes to financial investment properties.

PMI secures your lender in case you default on the loan, and it's more hard to secure PMI for financial investment residential or commercial properties. While some lenders like Fannie http://sites.simbla.com/07d65e1f-4dde-e48a-3e26-3c1ea7d12e5d/elwinnocpz6825 Mae will work with a minimum of 15% down, going this route will eventually consume into your bottom line. According to Zillow, the premiums for private mortgage insurance coverage can range from $30-70 monthly for each $100,000 borrowed.

The 6-Second Trick For How To Finance A Private Car Sale

" That's the gold requirement," states Peterson. Individuals are most likely to default on rental residential or commercial property mortgages than the homes they actually reside in, according to Peterson. Because of this, the majority of loan providers adjust their rates by roughly half a percent above normal rates for a primary or second house. It's perfectly fine to shop around for loans, but see out for loan providers who use rate of interest that are much lower than others.

However if it's method lower, loan providers are typically attempting to sell you on rates and charges for main residences," Peterson encourages. "Check out reviews and make sure you're working with a reliable lender who is familiar with financial investment residential or commercial property funding particularly, because it is rather nuanced compared to buying a primary home," states Peterson.

" If you have a great credit history, down payment, and either W-2 income or proven self-employment earnings that we can document for a minimum of two years, dealing with a direct lending institution will get you the very best pricing," keeps in mind Peterson. Another benefit of working with a direct lending institution, such as a bank or mortgage company, is that they have whatever in home.

They have their own underwriters (how much negative equity will a bank finance). And since they are that much closer to the decision-makers, you're going to get a lot more transparency in terms of what your rate really is, what your costs are going to be, and where you stand in the procedure," he adds. Additionally, a certified home mortgage broker serves as an intermediary and will try to match you with a lending institution that finest meets your requirements.

Bigger organizations have more resources, however are frequently less versatile in what they can do for you with funding. They will often include extra overlays (constraints) on top of Fannie Mae and Freddie Mac's standards. You may need a higher credit report, more money reserves, and greater earnings. There may be tighter limits on the variety of homes you can finance.

However, under Fannie Mae's guidelines, you can have up to 10 home mortgages on your individual credit. Smaller banks, on the other hand, are more likely to go straight off Fannie Mae and Freddie Mac's requirements. Bigger banks have longer, more governmental procedures, and might take up 60 days. Smaller direct loan providers can close in one month or less, which implies you begin making passive earnings sooner.

What Does What To Do With A Finance Degree And No Experience Do?

Some costs will be the same no matter which loan provider you choose, and others will differ by state law, lender, and type of home loan. To accurately compare lending institutions, review your official loan price quote. All lenders are needed to utilize the exact same loan price quote kind from the Consumer Financial Defense Bureau.

Unlike rate sheets, the loan price quote consists of binding not approximated lending institution charges. "A lot of purchasers will choose a loan provider based upon an advertised rate without evaluating a main loan quote," states Peterson. Unfortunately, that marketed rate is typically for main homes. In addition, "some loan providers may synthetically deflate particular expenses in the beginning," Peterson continues.

Make certain you're comparing the exact same rate of interest, for the exact same loan quantity, for the exact same purchase cost. That method, you'll understand what the straight-out expenses are for a particular rate." This allows you to focus on finding the ideal property financial investment for you regardless of where it lies and be ready to act rapidly when the time is right.

This is a major financial deal, and you need to feel comfortable with the individual you're going to be handling potentially every day for one month. Discover someone who returns your calls without delay and is keeping an eye out for your best interests. Roofstock partners with vetted providing partners like Better Mortgage to assist make the financing procedure as seamless as possible.

Given that then, lending practices have actually ended up being more conservative. Currently, 30-year, fixed-rate home mortgages are generally the finest method to go, according to Peterson. This type of home mortgage typically needs the most affordable regular monthly payment. Plus, you'll constantly understand precisely what the regular monthly mortgage payment will be. This stability makes it easier to budget, figure out lease, and prepare for future financial investments.

On the other hand, adjustable rate home mortgages can change regular monthly throughout the life of the loan based upon market conditions, putting you at danger for unanticipated jumps in your mortgage payments. If you're considering using for a financial investment loan, event as a number of the necessary files ahead of time can help jumpstart the process.

The Best Strategy To Use For What Basic Principle Of Finance Can Be Applied To The Valuation Of Any Investment Asset?

Most of the time your home mortgage lender will do an appraisal of your home. But it's clever to pay for a home examination yourself prior to you make a deal, so there are not a surprises down the line. Bankruptcy, divorce, or separation documents, if suitable Want to discover more about the power of utilize? Here's a webinar from our Rooftalk series that covers techniques for financing and refinancing.

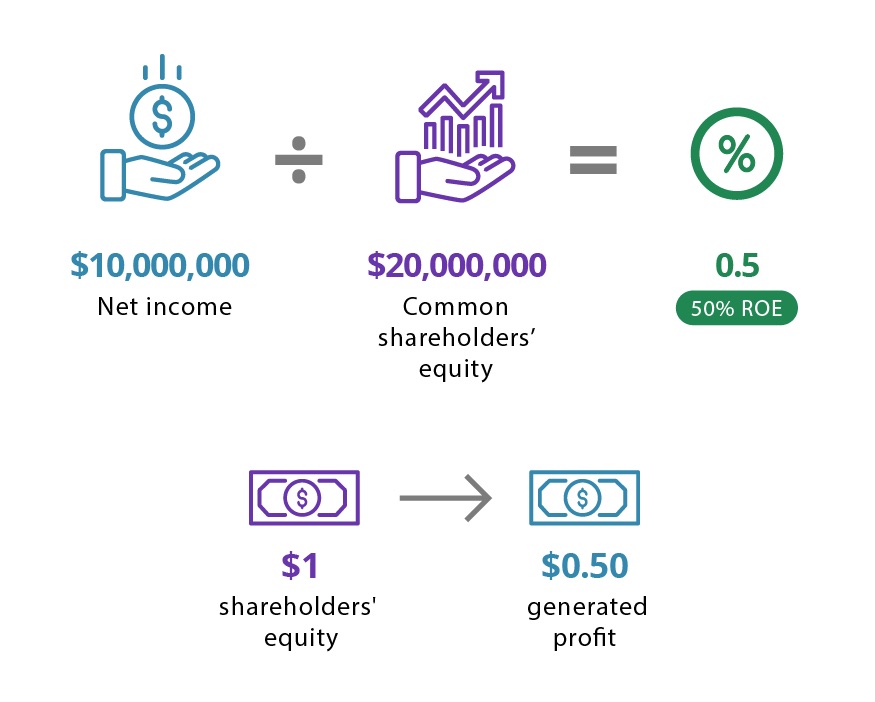

As a rental homeowner and property owner, your main objective is to end each month with a positive capital. To understand if a rental home is a clever investment, you need to estimate your prospective return on financial investment. Roi (ROI) is a method to understand how important your financial investment is.